We look at what is happening in the property market during May 2024 as buyer demand soars.

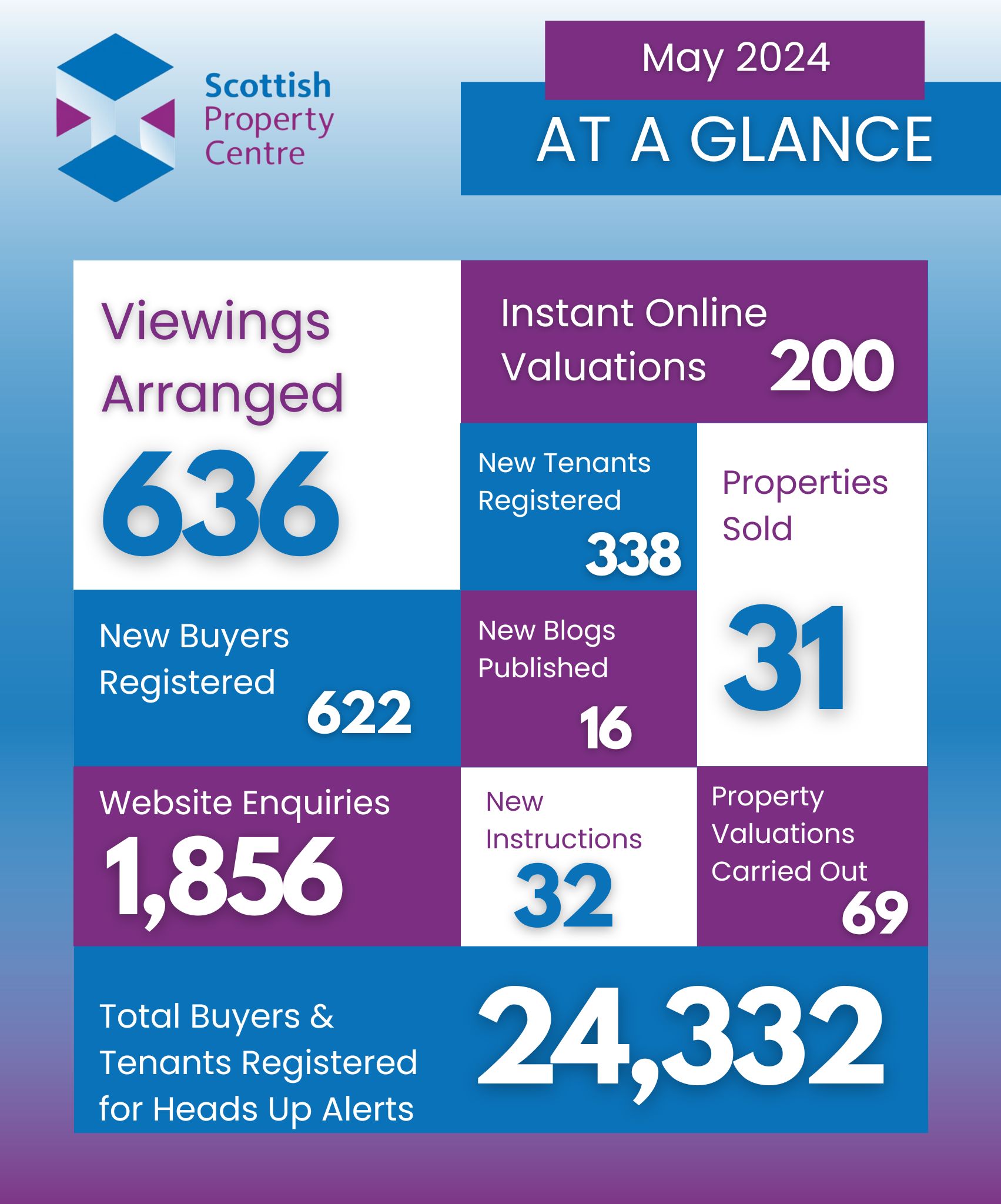

As you can see from the above snapshot of our figures for the month to date (1 May – 28 May 2024), we agreed 31 new sales with 32 new properties coming to the market during the month.

Buyer demand is soaring even higher with 622 new buyers registering during May for our ‘Heads Up’ property alerts. This is a 35% increase compared to last month and 15% up compared to the same period for May 2023. We also arranged 636 viewings for our clients and received 1,856 website enquiries for their properties.

The lack of available rental properties is still causing an issue and has resulted in record rents. An additional 338 new tenants registered with us during the month and we only have 4 properties available.

Craig Smith from the Shawlands branch commented “The southside of Glasgow appears to be experiencing another mini-boom at the moment. Over the past month we have witnessed buyer demand soaring, particularly with first time buyers. Many we speak to at viewings are familiar faces from last year, returning to the market after taking a step back whilst interest rates increased. Confidence and enthusiasm are back and this surge in buyers, we are up 35% from last month, is pushing many properties to new record sales.

1 bed tenements are the hottest properties in the area just now. This month we sold 3 in quick succession, all for in excess of 20% over the home report value, amounting to an incredible cumulative figure of almost £100,000.

We’re not sure how long this mini-boom will last though. Euro 2024 starts in Germany on 14 June and with Scotland competing (and hopefully progressing out the group stage!) many buyers are likely to become distracted during the tournament. We also now have a general election on 4 July, along with schools finishing/summer holidays starting which could all have some short-term impact with buyers pre-occupied.

If you’re thinking of selling, my advice is always to speak to us as early as possible in the process. The hardest part for a lot of owners just now is juggling the two sides of buying and selling, and what to try and do first. The earlier we meet you, the better advice we can give.”

Here are some of our success stories during May:-

Shawlands, Glasgow branch

This month we highlight 3 sales by the Shawlands branch that demonstrate the current competition between first time buyers and the demand for 1 bed tenements. Between them, these properties had 81 viewings in just 1 week and achieved a staggering £97,299 over the home report value.

Kilmarnock Road, Shawlands – 1 bed flat in iconic B Listed building with a roof terrace offering stunning panoramic views – sold for more than 20% over the home report.

Holmhead Crescent, Cathcart – 1 bed tenement flat with a dining kitchen - sold at a closing date for more than 20% over the home report.

Calder Street, Govanhill - 1 bedroom tenement with a dining kitchen - sold at a closing date for more than 25% over home report

Cardonald, Glasgow branch

Gladsmuir Road, Hillington – Lower cottage flat sold at closing date for more than 10% over home report value.

Mosspark Oval, Mosspark – Semi detached home sold for more than 5% over home report value.

Paisley Road West, Bellahouston –2 bedroom flat sold for almost 15% over home report value.

Dunoon, Argyll branch

Bullwood Road, Dunoon – Semi detached home

Ardenslate Road, Kirn – Detached bungalow

Church Street, Dunoon - 1 bedroom flat

Rightmove House Price Index

We take a look at what is happening nationally with the latest Rightmove House Price Index. Here are the keys takeaways from the report:-

• The average price of property coming to the market for sale reaches a new record of £375,131, rising by 0.8% (+£2,807) in the month

• The market remains price-sensitive with average asking prices just 0.6% higher than a year ago

• Pent-up demand from would-be buyers who paused their plans last year is a key driver behind increased home-mover activity despite mortgage rates remaining elevated for longer than anticipated

• The number of sales being agreed during the first four months of the year is 17% higher than last year, outstripping the 12% increase in the number of new sellers coming to market

• In Scotland, the average asking price is now £196,619 which is a 0.6% increase from last month and 2.7% increase year on year. The average number of days to agree a sale in Scotland is 34.

As always, if you have any questions relating to the property market or would like to discuss the current valuation of your home, please feel free to get in touch with your local Scottish Property Centre branch.

Looking to move in 2024? Register for our ‘Heads Up Property Alerts’

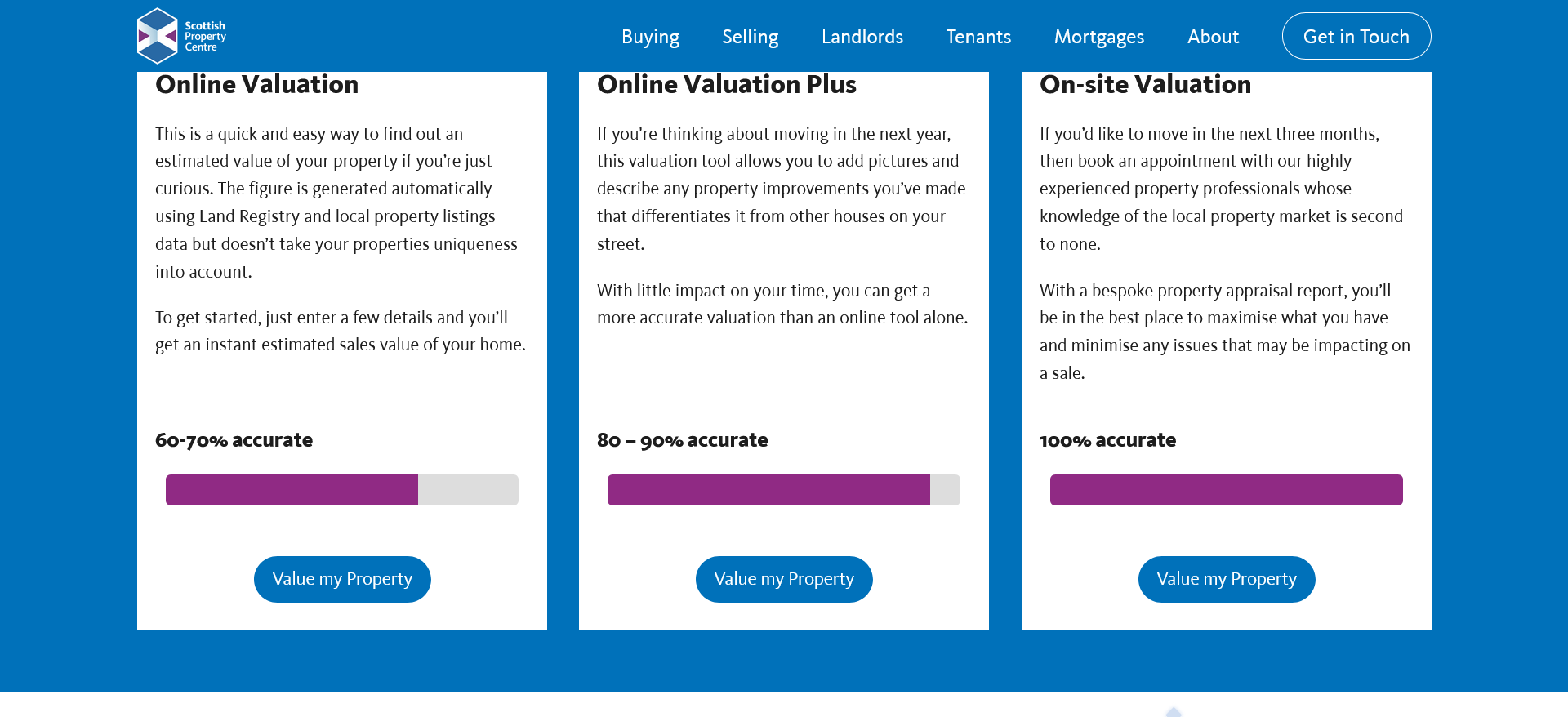

Do you know we offer 3 types of valuation? This includes an instant on-line valuation, you can get started here.

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link